Advertorial

2024 | SUMMER

Financial Resiliency For Officers and Families

Kenyetta Stroud

Advertorial

2024 | SUMMER

Financial Resiliency For Officers and Families

Kenyetta Stroud

Today’s policing environment is more complex than ever before as officers face a growing array of challenges, opportunities, and threats in their day-to-day operations. This stress can also be compounded by marital and family issues and is one of the biggest stressors in our personal lives—financial uncertainty.

Just as your mental and physical wellness on the job is important, financial wellness is equally important. Financial wellness isn’t equivocal to simply the amount of money one makes as a measurement of financial success. Instead, it pertains to how well one manages one’s finances and establishes a degree of stability that leads to a more enjoyable life. With financial stability, it becomes easier to maintain a positive lifestyle and to work toward achieving future goals.

To achieve financial stability, it takes resilience. Resilience is the ability to adapt well in the face of adversity, trauma, tragedy, threats, or significant sources of stress—such as family and relationship problems, serious health problems, or workplace and financial stressors. While financial resiliency is the ability to withstand life events that impact your income. This might be a job loss, a reduction in income, a major household or lifestyle expense, a divorce or family extension—all have a profound influence.

There are many ways to increase your resilience. Some of those include having a good support system, maintaining positive relationships, having a good self-image, and having a positive attitude.

INCREASING YOUR FINANCIAL RESILIENCY

To become financially resilient, a financial plan can help you stay focused on what matters most and help you prepare for things that might shake your financial resilience journey.

A financial plan is not just a resolution you make on a whim, but a well thought out and detailed blueprint for how you are going to make a difference.

It helps you to understand where your money goes. Having a financial plan and sticking to it is one of the keyways to build your financial resilience. To build a financial plan, ask yourself some questions…

- What do I want to achieve?

- Why is having a plan important to me?

- Why have I made previous financial decisions?

Your answers are the basis of your financial plan. Once you have these answers you can then focus on an action plan to meet your financial goal.

REDUCE OR ELIMINATE DEBT

Make your best estimate of current income and expenses and consider ways to close the gap by eliminating or reducing debt. Decide which debts you want to pay off first. A good place to start is the ones with the highest interest rate then work backward.

CREATE A SPENDING PLAN

It’s important to understand where your money goes and how spending and saving affect your financial resilience so you can take control of your financial position.

Some payments are fixed, like rent, food, and travel costs. Other types of consumption can be regarded as extra or luxury expenses and are costs which you have a choice over. Understanding how much of your money is spent on these items is key to building financial resilience.

CHOOSE THE RIGHT SAVINGS ACCOUNT

A key component of building healthy savings is choosing the right savings account. There are many diverse types of accounts that earn dividends―traditional savings accounts, certificates with short and long terms, and money market accounts that allow a limited number of withdrawals per month without penalty. No matter the type of savings you select, you’ll earn money on your money based on the account’s annual percentage yield.

A Freedom Direct Savings account from Justice Federal offers a remarkable annual percentage yield of 4.20%* when you establish a recurring direct deposit to a Justice Federal checking account.

As of June 2024, the national average yield for savings accounts is 0.58%, according to Bankrate’s survey of financial institutions. In addition to a high-yield rate, Freedom Direct Savings provides you with freedom from fees, and no minimum balance requirement. You have flexibility to access your savings whenever you need, without penalty.

BUILD YOUR KNOWLEDGE

Financial resilience and personal finances can be a daunting world when you have little knowledge.

62% of Americans would rather talk about religion, death, or politics than discuss personal finance with a loved one. Fear of embarrassment and conflict are major emotional roadblocks that hamper financial progress, reports CNBC.

Challenge yourself to constantly learn about how you can improve your own personal finances through financial knowledge, it’s key to overall financial wellness.

Working in the law enforcement profession is hard enough. When coupled with concerns about buying a house, paying for college, paying down student loans, and retirement, these stressors are equally concerning. Work with your spouse and family to communicate your financial goals, to help reduce stress about money now and into the future, and see your best future realized.

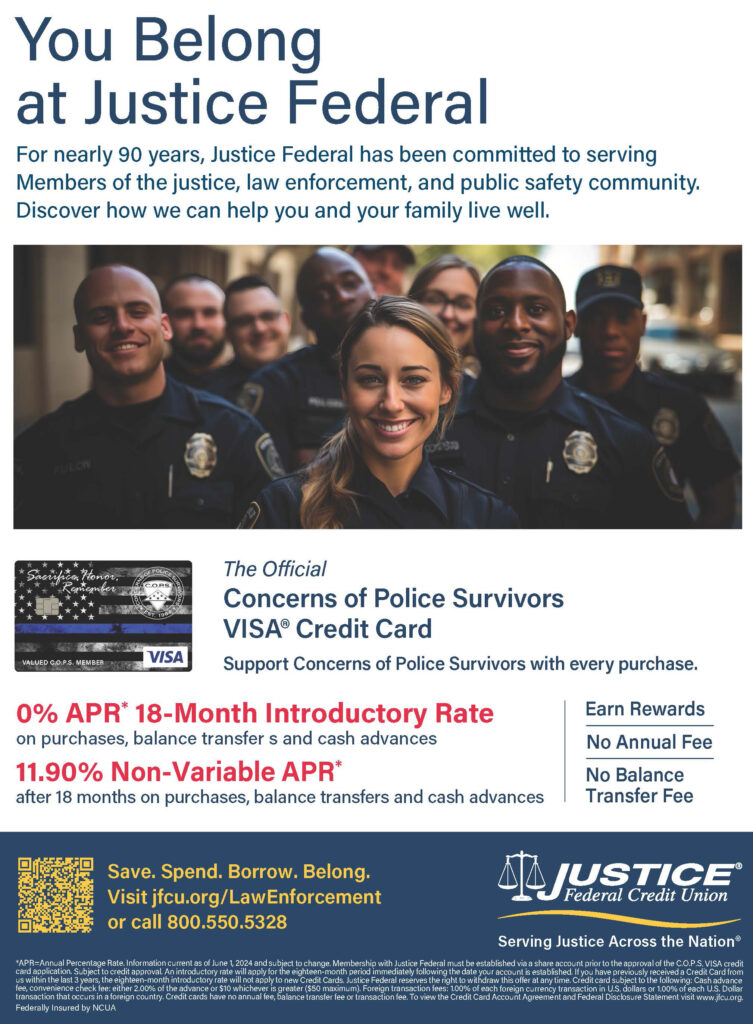

WE UNDERSTAND WHAT IT MEANS TO SERVE

Justice Federal has proudly served the justice and law enforcement community since 1935. To us, the real meaning of service is more than the use of a simple word, it is a lifelong dedication and commitment to helping our Members and their families to a better life, to higher standards.

For us, the only way to provide service is to totally commit our heart and soul into looking after our Members as though they are our own family. We promise to do the same for you and everyone who places their trust in us. That’s what we believe true service really means.

We realize that achieving financial wellness is essential to enhance your physical, mental, and emotional resilience. Our team of certified Credit Union Financial Counselors stand ready to assist you with creating a spending plan, restructuring your debt, and more. For assistance, please call 800.550.5328 and request to speak with a Financial Counselor.

We look forward to welcoming you and your family to our Justice family.

David Blake

Duane Wolfe

Guler Arsal

Joel Suss

*APY= Annual Percentage Yield. APY is subject to change without notice. Rate effective June 1, 2024. Freedom Direct Savings will earn 4.20% APY on balances up to $25,000 if the accountholder has direct deposit(s) of at least $500.00 to a Freedom Direct, Justice National, or Beyond the Badge Checking Account during a month. Balances over $25,000 will earn 0.150% APY and all balances in a month when qualifications are not met will earn the standard Share Savings APY starting at 0.100%. One Freedom Direct Savings per Justice Federal membership. Justice Federal reserves the right to withdraw this offer at any time.

Kenyetta Stroud

Kenyatta Stroud is a certified Credit Union Financial Counselor, and Branch Manager IV with Justice Federal Credit Union with branches located in the Georgia Department of Public Safety Headquarters, and the Georgia Public Safety Training Center. Kenyetta has over 15 years of experience in the financial industry and embodies the Credit Union philosophy of “People Helping People.” She is passionate about helping Members align financial products and services to achieve financial wellness and lead a more enjoyable life.

Justice Federal Credit Union serves over 63,000 Members of the justice and law enforcement community, with branches in the Washington, DC metropolitan area, as well as Los Angeles, Atlanta, Chicago, Miami, New York, Texas, Virginia, and West Virginia. To establish membership, learn more about a product or service; seek confidential financial counseling, or explore a partnership with Justice Federal, please contact Kenyetta Stroud at 800.550.5328 extension 42301, or visit www.jfcu.org, or your nearest branch location.